INDEPENDENCE DAY SALE 70% off Ends 7 8

Although QuickBooks Online is a great cloud-based accounting platform, it isn’t the only one. If you don’t need accounting just yet, our new money solution offers banking, payments, and 5.00% APY—all with no subscription or starting fees. Lots of bookkeeping services are built to run on QuickBooks, an industry leader in accounting and bookkeeping software. Some services also support Xero, another popular cloud-based accounting software. If you’re comfortable with your current software, ensure your bookkeeping service supports it.

QuickBooks Online Review

These are electronic fund transfers between banks that move money from your customer’s bank account to yours. QuickBooks Desktop has a more dated user interface than some cloud-based products and requires prior accounting knowledge to get the most out of the product. You can upgrade to any version reorder points of QuickBooks Desktop as your needs change. However, converting your data from one desktop solution to another can be a complex process. Each Desktop plan comes with one user; additional licenses cost extra. Ramp offers a free corporate card and finance management system for small businesses.

Streamline your business with Method

You’ll need to file business taxes manually, and update your QuickBooks account with the information afterward. You can track KPIs with in-depth analysis tools, consolidate data from multiple companies into singular reports, and compare different companies, clients, or franchises. You also get access to exclusive premium apps such as LeanLaw, HubSpot, DocuSign, Bill.com, Salesforce, and more. QuickBooks Online pricing offers five main plans, plus a host of add-ons for an extra monthly charge.

Negative Reviews & Complaints

- Like many top credit card processors, QuickBooks Payments uses Fiserv as its back-end processor.

- Small business owners get more deductions with AI-powered expense tracking and receipt matching.

- From there, the customer’s money will be deposited into the business’s account the next day, and the business will be notified as soon as clients view the invoice or pay it.

- Offers four plans to accommodate a range of businesses with different needs; each plan limits the number of users, though.

ACH stands for “Automated Clearing House” and refers to transfers of payments from one bank account to another. QuickBooks Payroll is a separate package from Intuit that operates on a monthly plan. The Online version (QuickBooks Online Payroll) has three pricing options with different levels of functionality, https://www.wave-accounting.net/ while the Desktop version just has one. According to our research, QuickBooks Online payment fees are more cost-effective than other providers. When choosing your accounting software, it’s smart to keep an eye on your wallet. QuickBooks Payroll is not included in your QuickBooks Online subscription.

There are additional add-ons, such as health benefits, 401(k) plans, and college savings plans, that you can sign up for as well. The main dashboard will give an overview of your QuickBooks account, showing your profit and loss overview, invoices, expenses and sales. QuickBooks invoices are optimized for mobile, which means customers will be able to view them properly if they are on their mobile device. Get the breakdown of the key features that matter to small businesses in our 2024 QuickBooks Online Invoicing review. Another notable difference is QuickBooks Online offers a Self-Employed version for $15 per month, which is not available with QuickBooks Desktop. For an extra $50, sign up for a one-time live Bookkeeping setup with any of its plans.

QuickBooks Online vs QuickBooks Desktop

Users can also add a Salesforce CRM connector for $150/month and QuickBooks Time Elite for $5/employee each month. Karrin Sehmbi is a lead content management specialist on the small-business team. She has more than a decade of editorial experience in the fields of educational publishing, content marketing and medical news.

As a QuickBooks ProAdvisor, Mark has extensive knowledge of QuickBooks products, allowing him to create valuable content that educates businesses on maximizing the benefits of the software. We are committed to providing you with an unbiased, thorough, and comprehensive evaluation to help you find the right accounting software for your business. We meticulously and objectively assess each software based on a fixed set of criteria—including pricing, features, ease of use, and customer support—in our internal case study. Locally installed basic bookkeeping tools, including invoices, industry-specific reports, time tracking, inventory management and more.

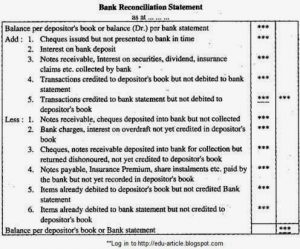

The rating of this company or service is based on the author’s expert opinion and analysis of the product, and assessed and seconded by another subject matter expert on staff before publication. Merchant Maverick’s ratings are not influenced by affiliate partnerships. When it seems https://www.online-accounting.net/bank-reconciliation-statements-bank-reconciliation/ like there is a business software application for everything, it pays to be choosy. Whether you use QuickBooks Payments or another payment gateway, be sure to take potential credit card fees into account when calculating how much you’ll be spending on software each month.

We weigh each section differently to calculate the total star rating. The more expensive plans include additional users, in-depth reporting, and advanced features. This includes the availability of integrations for payroll, time tracking, and receiving e-payments. We also evaluated whether an electronic bill pay integration was available. Businesses with inventory items should choose accounting software that can track inventory costs, manage COGS, and monitor inventory units. Most small businesses will find Plus the perfect fit, but there are many reasons you may want to upgrade to Advanced, especially now that several new features have been added to the program.

FreshBooks is great for self-employed individuals, sole proprietors and independent contractors. It is incredibly user-friendly and easy to navigate, so if you are a sole proprietor looking for basic accounting software, FreshBooks will meet your needs at a relatively low cost. Its basic plan is in line with QuickBooks Simple Start, at $15 per month. QuickBooks Online provides a suite of connected tools that work together to help clients track time, get paid, and pay their teams. With all business data in one place, they’ll have a clear view of business performance anytime, anywhere. Online services may offer one-on-one meetings, but you might have to pay more.

You also can invite reports-only users to run reports, but not make changes. Essentials is not a good fit for those who need to buy, sell, and track inventory, create purchase orders, mark expenses billable, track projects for job costing, or create budgets. If these needs apply to your business, consider subscribing to Plus. QuickBooks offers products that range from having no monthly fees, to $200 per month for the highest subscription level, QuickBooks Advanced. QuickBooks Solopreneur (formerly known as QuickBooks Self-Employed) costs $20/month or $120 for the first year. This software is best suited for freelancers, allowing them to track income and expenses, track mileage, estimate quarterly taxes, and run basic reports.